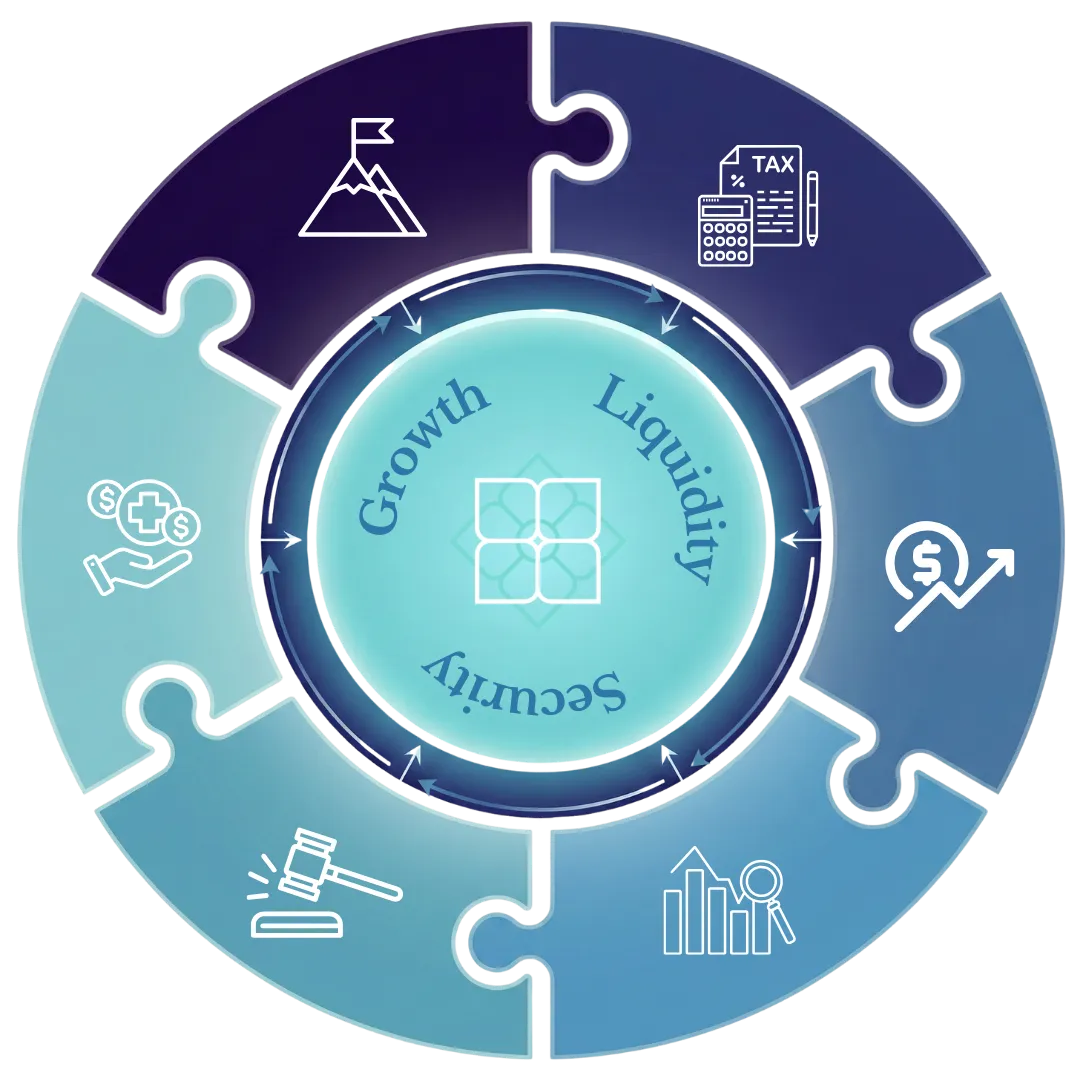

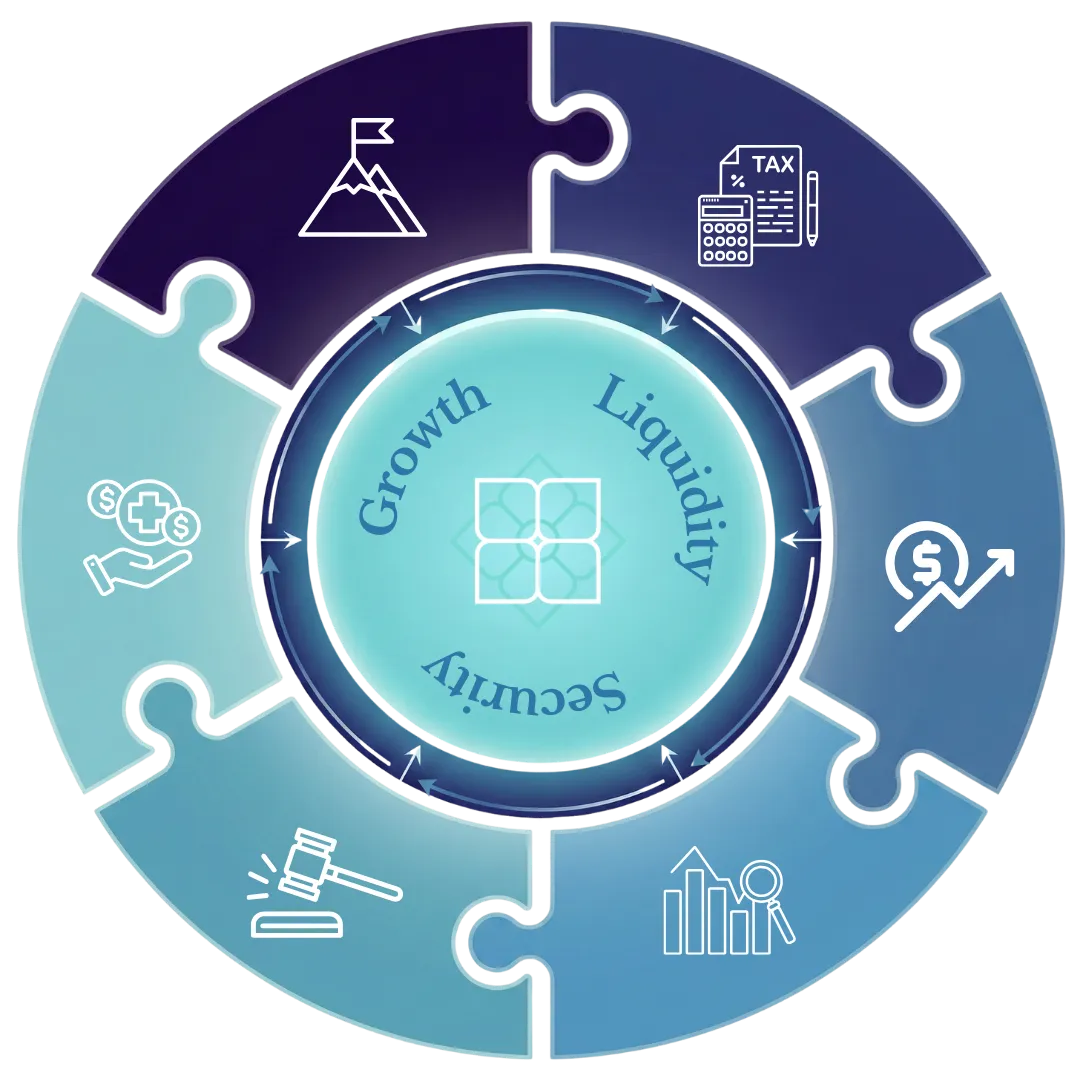

Maximize the Growth, Liquidity, and Security of Your Retirement

We F.O.C.U.S. on building the retirement income plan you dream of and deserve, so you can FOCUS on enjoying what matters most in life.

"Retirement plans, needs and goals are like snowflakes... no two are exactly the same! Our primary F.O.C.U.S. is taking the fret out of finances, and ensuring your plan is custom to your retirement vision." -Kara Stewart

Retirement isn’t just investing...

It’s building income you can count on.

Most people spend years climbing the mountain—saving and investing. But retirement is the way down. Maximizing your golden years requires the right F.O.C.U.S.

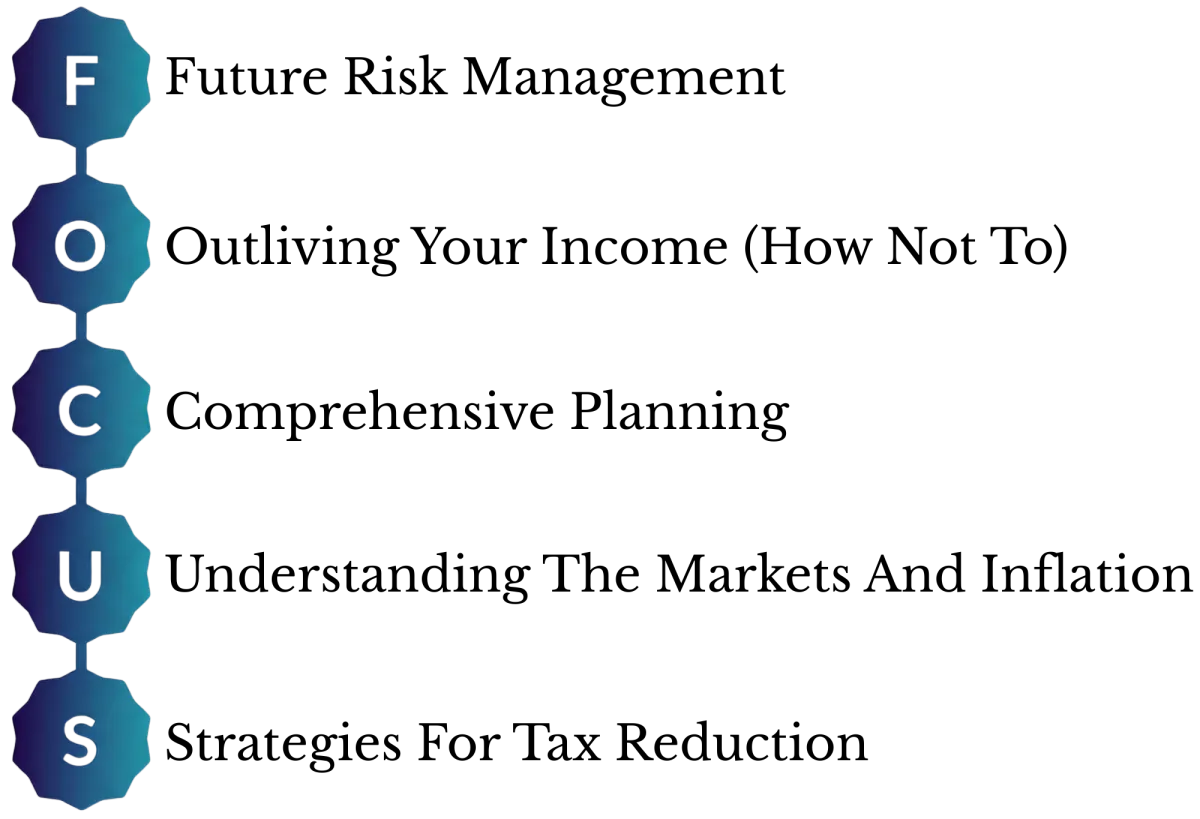

Introducing the F.O.C.U.S. Retirement System

A proprietary 3-step process to maximize the Growth, Liquidity, and Security of your retirement by eliminating unnecessary risk.

The Rules of Retirement Have Changed...

Strategies that worked just 10 years ago may not work today. Most plans focus only on growing your wealth, but in today’s economy you face a "Perfect Storm" of six distinct risks that can erode your nest egg faster than you can replenish it...

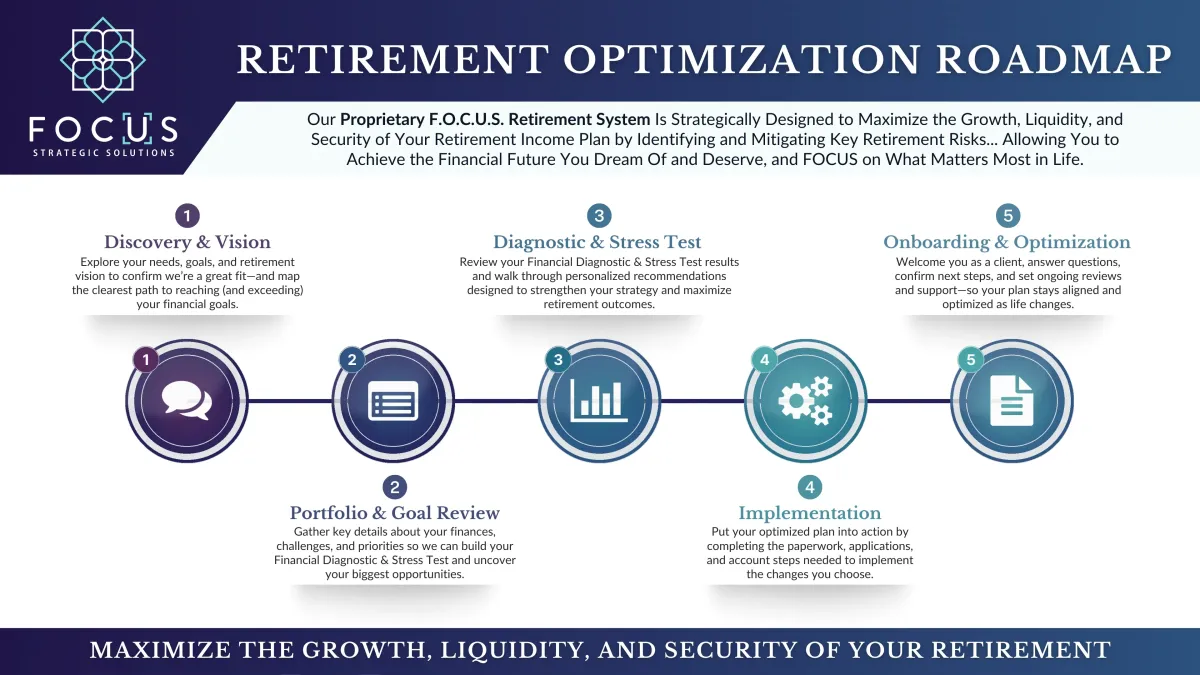

A Simple Roadmap to

Clarity & Confidence

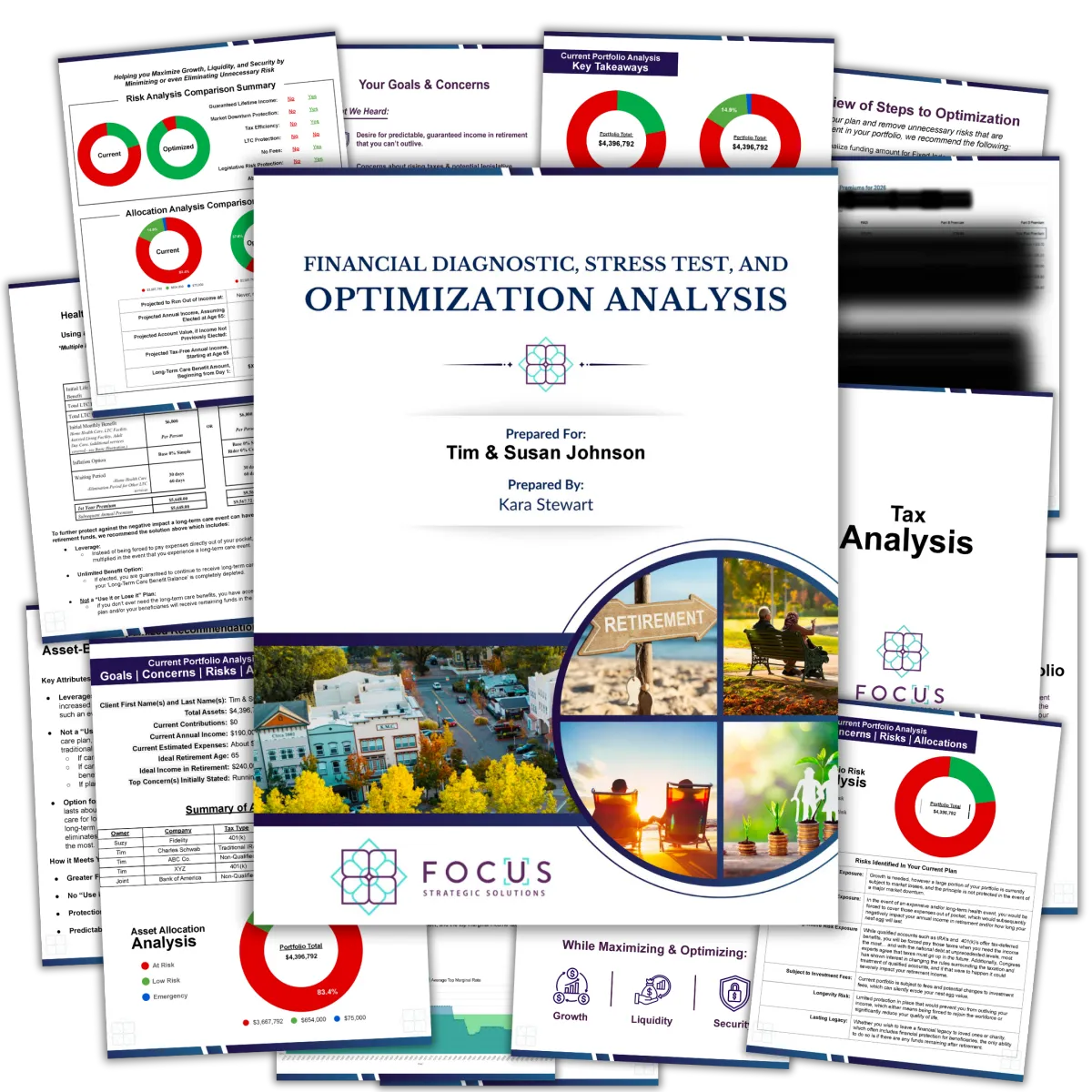

You wouldn't let a surgeon operate without an X-ray, and you shouldn't enter retirement without a stress test. Just like a cardiologist assesses your physical health before prescribing treatment, we use our proprietary F.O.C.U.S. Retirement System to uncover hidden risks in your financial plan that others might miss.

How It Works

The Financial Diagnostic

Most plans have "silent" issues that don't show up until it’s too late. We perform a deep-dive audit of your current portfolio to identify inefficiencies—from high fees to tax drag—ensuring you aren't unknowingly exposed to threats that could derail your retirement.

The Portfolio Stress Test

Hope is not a strategy. We virtually "crash test" your retirement plan against various economic scenarios, including high inflation, market volatility, and tax hikes. You will see exactly how your portfolio performs in good times and bad, so you never have to worry about outliving your income.

Strategic Optimization

Once we know the risks, we remove them. We restructure your assets to capture market growth while protecting your principal. The result is a customized roadmap designed to deliver tax-efficient income and liquidity, giving you the freedom to focus on what truly matters.

Ready to get started?

Meet Your Retirement Guide

Kara Stewart

Integrity, heart and passion for helping people.

"My passion is to worry about your finances, so you don't have to! And that includes making sure that you are set up for the retirement lifestyle of your dreams, without sacrificing today's needs.

When you're ready, don't hesitate to click the button below to schedule a complimentary, no-obligation strategy session with me so we can map out your path to retirement success. Your future self will thank you!"

-Kara M. Stewart

What Others Say About Us

Real People. Real Results.

"Kara Stewart with FOCUS is the most robust and diversified wealth manager I have ever met or worked with. Kara’s wide background in the many financial spaces has provided her access to a variety of different financial tools, which I now have access too. She provides everything individual specialize in individual investment types like, Mutual Funds, Life Insurance Policy, 401k, IRA.’s, etc… Kara offers all of these and more so working with her is like working with a team of financial advisors. Working with Kara allows me to think about the way I Grow and Manage my Wealth."

"I met Kara Stewart through my Foundation because she happens to be a supporter of Charitable Causes like I am. I retired from being an Investment Advisor, Financial Advisor & Planner several years ago, but I'm still asked for my Financial expertise and advice so I was referring them to one of my former students who became my Financial Planner. One of the problems was that he lived too far from my Referrals and they wanted someone they could meet with in person, so I did my research and came up with one of the Elite and top rated Financial experts in America. The real clincher for me was that one of my Dear friends and neighbors in the Independent Senior Living Community where I live, was asking me about some of her Financial questions and I referred her to Kara, who then became my Advisor too. I have so much respect for Sylvia Silverman that after she and her daughter met with Kara, I decided to join her too."

"I had purchased a Whole Life Insurance policy in 1990. It hadn't been reviewed for 10 years. After meeting with Kara and discussing my insurance needs and circumstances, I was comfortable with having her take a look and determine if my existing policy was still right for me. With Kara's analysis of my existing policy and recommendation, she was able to transfer me into a policy that provided a more efficient use of my money. I trust her expertise and knowledge and appreciate the time she spent to improve my financial health."

“I asked Kara to propose long term care for my wife and I. We had several meetings that in- cluded general information about the coverage and she provided specific proposals for our consideration that included several funding alternatives. She took the time to explain all our options and provided me with statistical information about claims and the financial sta- bility of the insurance carriers. Simultaneously, I had her review my existing life insurance policy. Her analysis concluded that the life insurance I had was eroding and I did not even know it. She suggested that I surrender the policy and take the built-up cash value. She provided me with a proposal for the same death benefit that I had for significantly less premium. Upon completion of this strategy, it gave me an influx of cash that helped me pay for my long-term care policy; which was important to me in protecting my assets.”

“Kara took the time to understand the specific needs of my wife and I prior to her proposal of product. She appropriately matched our needs with an insurance carrier and was patient with us as we had to make a few changes along the way. We were working on finalizing our estate plan simultaneously and Kara was able to update the ownership and beneficiary designation to accurately reflect our trust. As a managing partner of a wealth management firm in Sausalito, I feel confident in referring my clients to her for their insurance related needs.”

"My husband and I dream of retirement and, like everyone, want to live a long healthy life. Kara took a holistic approach to our financial future and provided us with safety of principal for our retirement accounts without giving up growth potential, and secured long term care coverage with no ongoing premium. I have peace of mind knowing that my husband and I have a solid plan for the future. Kara delivered impactful, long term results and is a pleasure to deal with."

"We are pleased with Kara's ongoing, forward-thinking advice. She has continually and appropriately recommended changes to our financial plan in order to meet our stated goals and objectives. The holistic approach she employed saved more than 40% on our current and future taxes. Her use of charitable planning helps us achieve our philanthropic goals without having to give away any control. She has greatly impacted our financial future and family legacy."

“Kara asked us what we wanted in retirement and after listening to us she explained our options in detail and in easy to understand terms. After modeling different scenarios with her, we were able to make well informed decisions. As a result, our assets are protected from market volatility , we reduced our taxes and generated additional retirement income! Thank you, Kara!”

Can I Ship You a Copy?

Discover the blueprint blueprint to the holistic & stylish retirement you've always dreamed of.... at no cost to you!

Can I Ship You a Copy?

Discover the blueprint blueprint to the holistic & stylish retirement you've always dreamed of.... at no cost to you!

You Only Get One Retirement...

We Help You Create the One You Dream Of and Deserve.

Complimentary Resources to Jumpstart Your Success

Free Book

Put Power in Your Purse

Your blueprint to the holistic & stylish retirement you've always dreamed of.

Free Book

The New Holistic Retirement

Learn how to navigate the markets, rising taxes and inflation in a post-covid world.

Free Book

The Power of Zero

Discover how you can disinherit Uncle Sam from your retirement income plan.

1-on-1 Strategy Session

Complimentary Consultation

During our chat we'll dive into your unique situation, needs, and goals.

quick links

Business hours

monday-Friday: 8am - 5pm

Copyright 2026. Kara Stewart - FOCUS Strategic Solutions. All rights reserved.